As the growth of mobile money in Africa soars, global payment giants Mastercard and Visa entrench an alliance with the region's mobile leaders to snap up millions of users with their virtual card offerings.

Seth Onyango, bird story agency

Mastercard and Visa are vying for the loyalty of millions of customers in Africa's multibillion-dollar mobile money space as incomes rise and cashless cravings intensify on the continent.

In its latest analysis, GSMA, the mobile network operator's trade body, notes that Mastercard is allying with MTN while Visa is allying with Safaricom to dominate the card payment business.

Behind the scenes, the two global payment giants are locked in a fierce battle for dominance among customers using their phones to send and receive money, pay bills, and access financial services.

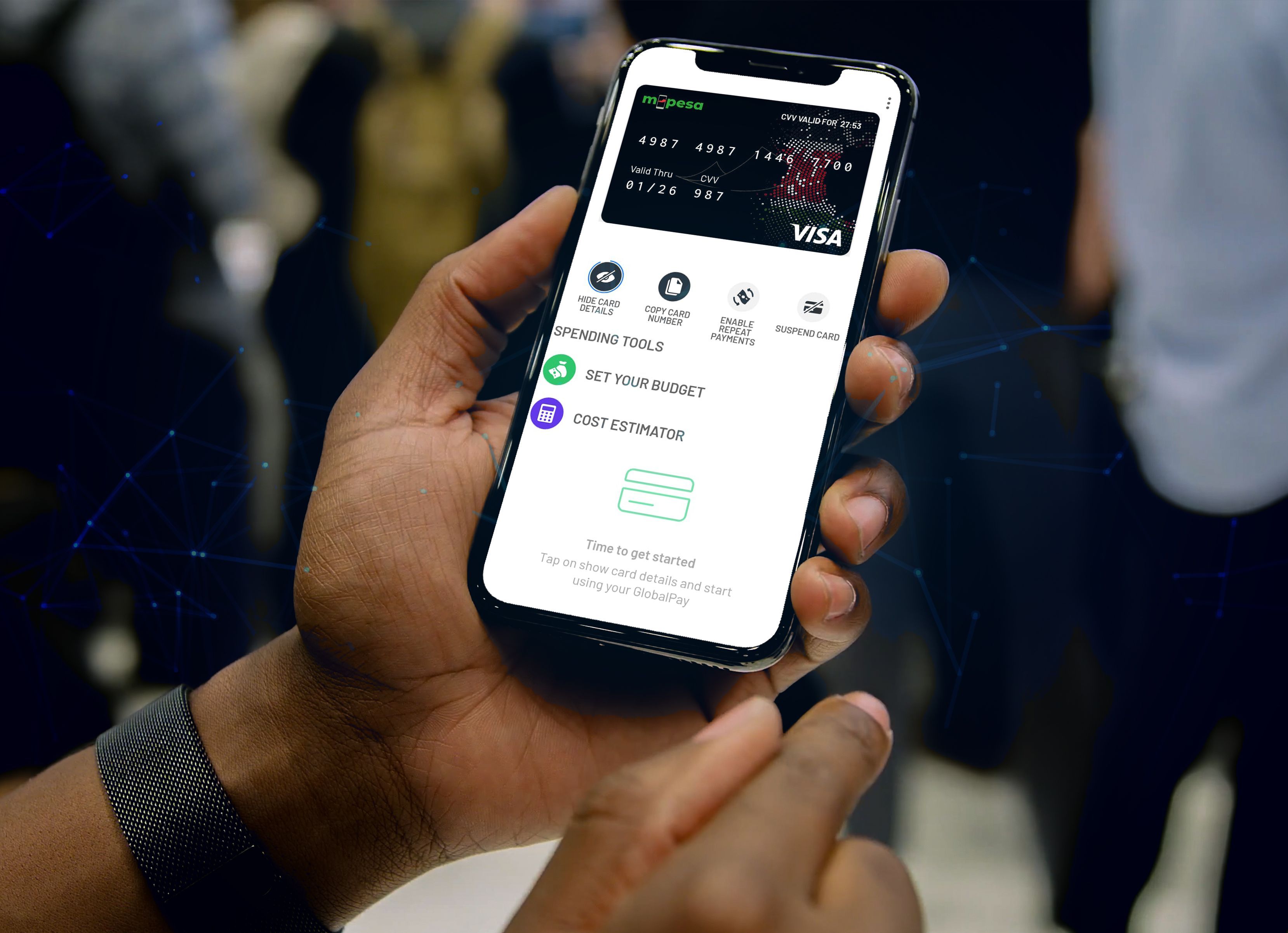

Both now offer virtual and physical cards across the telco's networks that can be linked to users' mobile money accounts.

These cards allow them to make online and offline purchases using funds from their mobile wallets at local and international merchants.

According to GSMA State of the Industry Report on Mobile Money 2023, these partnerships have driven the integration of the mobile money industry with the broader financial ecosystem.

Both Visa and Mastercard are expanding mobile money's use cases and benefits for banked and unbanked users.

However, these partnerships also reveal the competition and rivalry between Mastercard and Visa, who are trying to gain an edge in Africa's fast-growing payment market.

By partnering with different telecom companies, they are hoping to acquire and retain customers who may not have access to conventional banking services or may prefer the convenience and security of mobile money.

"Banked users can use their mobile money-enabled payment cards to potentially benefit from more favourable foreign exchange rates," reads the State of the Industry Report on Mobile Money 2023.

"In markets where accessing a bank account can be challenging for rural or low-income segments, such cards can drive financial inclusion by providing access to payment systems normally reserved for banked individuals."

Similar to debit cards, virtual cards allow users to purchase products and services internationally, utilising funds from their mobile money accounts.

This can be done online or while traversing the globe, vastly expanding the purchasing power of those who previously lacked access to such financial tools.

These offerings are exclusive to more established players, such as MTN MoMo, which partnered with Mastercard in 2021 to make virtual cards available across their 16 countries. In 2022, Safaricom M-PESA also launched their GlobalPay solution with Visa in Kenya.

Similarly, Airtel Money partnered with Mastercard in 2020 and has issued physical cards to its users in 14 African countries.

These cards enable users to make payments at local merchants that accept card payments. On the other hand, Orange Money partnered with Visa in 2020 and has rolled out physical cards to its users in seven African countries.

The report by GSMA notes that these partnerships can potentially increase financial inclusion and digital literacy in Africa, where more than half of the adult population still does not have a bank account.

However, it also cautions that there are challenges and risks involved in these partnerships, such as regulatory uncertainty, operational complexity, data privacy, and cybersecurity.

The report concludes that the mobile money industry in Africa is undergoing a significant transformation as it integrates with the global payment system.

It predicts that this trend will continue as more telecom companies seek to offer virtual and physical cards to their users.

It also expects these services to drive innovation and competition in the sector, creating more value for customers and businesses.

bird story agency